Overview

IRS. If you’re an American the name crawls in your mind and then onto your spine making you shiver. It’s the Internal Revenue Service, the agency responsible of collecting taxes and enforcing the tax laws. Most countries have a revenue agency, a governmental institution that collects revenue from the citizens in the form of taxes, investigates tax evasion and carries out audits.

As fun as those audits sound you can protect yourself against being bullied during one by keeping a straight record of your personal/business expenses and having your papers prepared.

If you have a mobile phone that you use for your business (self-employed) you should know that you are entitled to receive tax deductions for your business calls. Even more, if you received a phone from your employer you will be required to provide a report on how much did you spend for business calls for the same purpose, your employer wants to deduct as business expenses the phone calls. The IRS (US) stipulates how phone calls made for business purposes can be deducted here, the HM Revenue & Customs (UK’s revenue agency) gives examples on that here and the Indian Revenue Service … well they have other problems since only 3% of their citizens pay taxes, the rest enjoying the national sport of tax evasion. Joke aside, if you want to be prepared for an audit from your revenue agency (no matter what country you’re in) be sure to clearly separate your business calls from your personal ones and keep records on phone usage. Here are some general guidelines that should apply in most situations:

- Personal and business use allowed. If you have a mobile phone you are allowed to use it for personal calls as well, as long as the primary use is a business one (at least in the US). In this case you can deduct mobile phone expenses (calls/sms) but only those related to the business side, not the personal ones. So if you use it 51% for business and 49% for personal, you’ll be able to deduct the expenses associated with the 51% use.

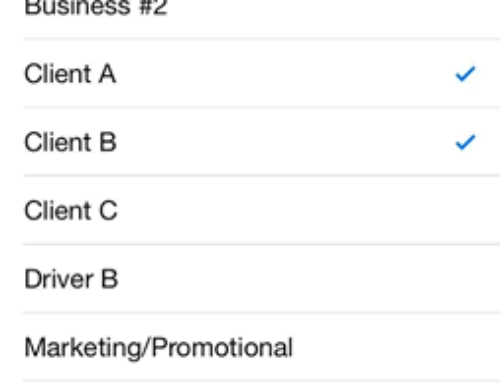

- Mark as business. Separate your business calls/sms messages from the personal ones to be able to produce a report only for the business side. If you own an Android smartphone, the app presented below, Business Call Claim, will help you in doing that. You’ll be able to easily mark as business related conversations such as: calls to customers, colleagues, employees (or employers), potential customers (sales leads), meeting setups, etc.

- Report to employer. If you’re not self-employed you can deduct the use of your cell phone (business side) directly to your employer. Again, just as with the example above you’ll need to keep a record and separate business vs personal calls. As a general rule you’ll also need to include only the calls made during the regular business hours of the company you work for.

- Prepare for the audit. If you’re unlucky enough to be the ‘chosen one’ for an audit, the expenses related to your smartphone will be analyzed as well. That’s why you need to have reports and ready to show them which ones were submitted for deduction due to their business nature. You will also need to maintain copies of your call bills and I’d say that a list of business contacts would help as well.

The app

‘Business Call Claim’ is meant for these situations, the ones where you need to keep a record of your business contacts, calls and sms messages in case you get audited or if your employer requires a monthly report. Of course, another way around this would be to use a phone only for business use, and another one only for personal use. But in practice this is an inconvenient as you’ll have to maintain and carry two phones with you, always being sure which one is for business and which isn’t. Not to mention the cost would double, so why not use the solution that helps you separate those types of calls.

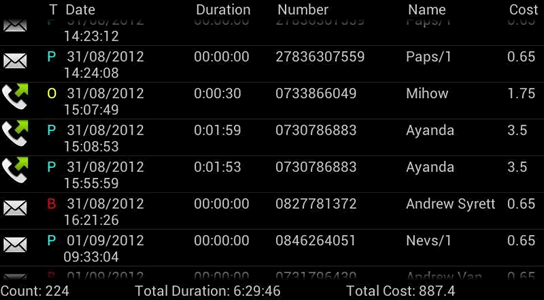

With ‘Business Call Claim’ you can easily identify which calls/messages were for business with a simple swipe. It also allows you to set your own charge rate either by changing it for the entire app, or simply right before generating a report. As far as reporting goes, you can create usage summaries and claim expense reports that can be emailed to your employer if needed (the email feature is only available in the Pro edition). The video below shows ‘Business Call Claim’ in action:

The app is installed and used directly on your phone without requiring you to create an account or store your reports online. Here’s how you can use ‘Business Call Claim’ based on the actions it has in its dashboard:

- Manage contacts. You can add/edit/delete contacts and mark them as Personal, Business or Other. In fact when you add one you’ll be asked for their name/number and type of contact. If one contact is marked as business, all the conversations done with that contact will be marked as business too. This clearly eases the separation of calls, especially if you have a list of business contacts that you do most of your business discussions with. Once a contact is added, from the list of available contacts you can swipe (either left or right) to switch between the type (i.e. personal, business, other). Thus once the contact is defined you don’t need to pull up their listing and edit the type as you can do it with a simple swipe.

Manage contacts

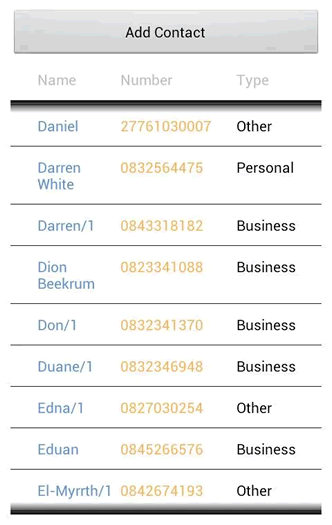

- View billing. Let the reporting begin. When you tap on this you’ll see a set of filters that you can apply to your calls/messages before generating the report. You’ll be able to specify if you want to include all contacts or only the business ones, call types (calls, sms or both), the from and to dates for the report and billing information. By default under billing the settings specified in the general options page of the app will be used, but if you want to use different ones only for this report you can set here the charge per minute for calls, cost for messaging and the billing type (i.e. per second or minute). Tapping on the ‘Display report’ button will bring up the actual billing report with several columns that will show: if it’s a message or call, type of call (business/personal), date, duration, number, name and of course the individual cost. At the end of the report you’ll see how many entries there are (count), what the total duration for the given period of time was and finally the total cost of all your conversations. This report can be emailed to a specified address (i.e. your employer). From this report you can also swipe on a given listing to change its status from personal to business or other.

Billing report in Business Call Claim

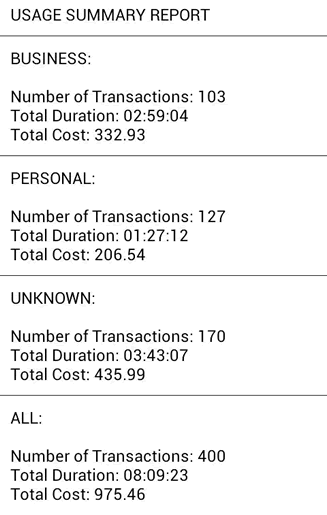

- Usage summary. These reports are a simplified version that will create a brief usage summary based on analyzing your calls/messages. There are 4 sections shown, business/personal/unknown/all, and under each of these sections you’ll see the number of conversations, the total duration for those conversations and the total cost.

Summary of business/personal usage

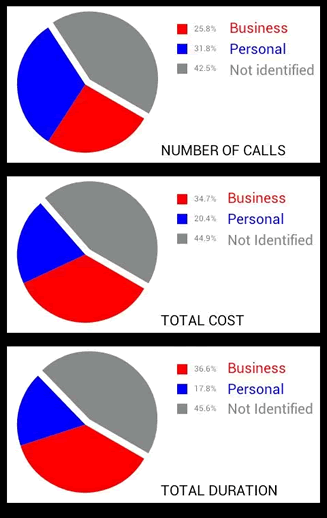

- Compare usage charts. This will create pie-charts showing the percentage of business, personal or other conversations. Aside the pie-chart for the total numbers of calls it will generate two more for the total duration of the conversations and the total cost. It’s easier to identify this way how much time you spent on business calls and what was the cost for that.

Usage charts by type

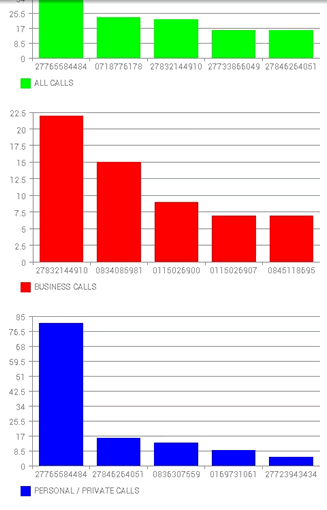

- Top 5 most frequently dialed numbers. Self explanatory option that will show a bar-chart where the top 5 most called numbers will be represented. It will show a graph for all the calls, another one for personal calls and also one for business calls (i.e. top 5 dialed numbers for business purposes). For each bar you will see the number dialed and the amount of minutes spent in total conversations.

Frequent dials report

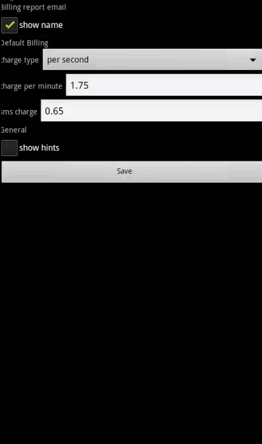

- Settings. Accessing this menu you can modify the general app settings. You can choose to show the name for the billing report email, modify the predefined billing options (charge type, amount to charge per minute and on sms messages) and the option to hide the hints that are shown by default through the application.

Application settings

Conclusion

If you’re looking for a solution to claim your business related phone charges then give ‘Business Call Claim’ a ride as it will definitely be easier to separate business and personal calls. It’s just a matter of swiping on a contact or a logged phone call to mark it as business. The app is free however there is a pro version as well that, in exchange for a $1 fee, will allow to: email billing reports, unlock all reports, run reports on all call-history, remove ads and expiry date.

You can download the app directly from Google Play: Business Call Claim

Name: Business Call Claim

Developer: DevMouse3 Studio

Size: 0.7Mb

Package: callLogger.Package.apk

Version: 1.13

Last update: July 22, 2013

Price: Free